Ultimate Guide to Group Health Insurance

A comprehensive guide to the most important employee benefit (other than salary): Group Health Insurance.

![]() Group Health Insurance Preface

Group Health Insurance Preface

Employee Benefits Asia are leading experts and have compiled our free Ultimate Guide to Group Health Insurance. We hope you find this valuable and give us a chance to help your organization find the right balance between cost, benefits & service.

To begin with, group health insurance is not easy, especially for someone without deep industry experience. There’s a lot of information, many providers & it’s easy to get confused. Therefore, our goal: make it simple for you & your team.

With that, please enjoy our blog.

– Quinn Miller | Founder

Group Health Insurance Providers

To start, there is no shortage of insurance providers who offer group health insurance to companies in Asia. They include, but are not limited to:

- Allianz

- April

- AXA

- Bupa

- Cigna

- Generali

- Henner

- Healthcare International

- Liberty

- Lloyd’s of London

- Luma

- Morgan Price

- MSH

- Now Health

- Optimum Global

- Pacific Cross

- VUMI

- William Russell

Given that there are so many options, we recommend using a reputable insurance broker in your search for group health insurance. It saves you time, hassle & headaches of sourcing quotes, understanding them & putting them together in an apples-to-apples comparison. Use a broker like EB Asia and get an expert on your side and added customer service without any additional charges.

Plan Strucutre Options

There are many different ways to structure your policy:

- All employees with the same provider and the same plan selection

- All employees with the same provider, but different plans by employee tier

- Different providers by employee tier (ex. C-level with international provider & regular with a local provider)

- Only certain employees, such as keypeople, owners, directors or higher management

- Fully cover the expense

- Do a cost-share

- Create a flexible benefits program

- Provide them an allowance and they choose whichever provider & plan they want

Employee Tiers

An important thing to think of is ‘Will everyone have the same plan?” or will there be different tiers for the owner/directors, middle management & regular staff? Ultimately that decision is up to each individual company in how they structure their plan. In our 10+ years of organzing group health insurance to businesses in Asia, we usually see newer/younger companies who put everyone with the same provider, plan & budget. As a company matures & headcount grows is when you see companies introduce tiers. Let’s look at the Pros & Cons of employees tiers & what aspects could differ if you introduce tiers.

Pros

You can split the plan, giving each group of employees suitable coverage they want within budget for each tier

Cons

You have people under-insured (owners, directors, management) or over-insured & overpaid (regular staff)

Dependents

You can optionally covered your employees’ dependents on a group health insurance plan. This includes immediately family members like spouses & children.

By covering dependents the number of insured grows as would your premium, so this something you really need to consider when setting up a plan as part of your overall strategy. You could:

- Cover no dependents

- Cover all dependents

- Cover some dependents for higher employee tiers or eligibility criteria

- Create a dependent opt-in plan, where the employees could optionally have their dependents be on the group plan, usually at the employees expense or do a cost-share model

- Dont’ cover any dependents as part of the group health insurance plan, but provide all/certain employees an allowance

Coverage Area

Each provider will have their own unique set of coverage areas to choose from, but largely speaking they generally are broken down as follows:

1) Regional Cover, could include:

- Country specific cover only, eg. Thailand

- Southeast Asia excluding Singapore

- Asia excluding China, Hong Kong, Singapore

2) Worldwide excl. USA

3) Worldwide

By reducing the geographical coverage area, you reduce the risk to the provider and thus get better pricing. Even within Asia, if you remove countries that have more expensive cost of healthcare you can save 25-30% on your premium.

If you have employees that live in different countries, then we will help make sure we manage the costs while getting everyone adequately covered.

Group Health Insurance Benefits

Which benefits you offer is likely one of the first things considered for any group health insurance. There are many benefits, but they broadly fall into one of the following benefit categories.

Inpatient

For overnight stays in the hospital for more major things like surgery, cancer, recovery & more

Outpatient

For minor visits to a doctor, where you get basic treatment and go home the same day

Dental

Dental includes Major & Minor dental to cover everything from basic visits & surgery

Maternity

Covers everything from pre-natal, routine delivery, complications, vaccines & more

Evacuation

Usually included by default, evacuation is important to have due to the high costs for this service

Life Cover

Optionally include life insurance benefits with your plan, from term-life, critical illness & more

Which benefits you take is ultimately up to you & varies by organization. We can help advise based on the norms of your industry, trends & from our experience.

If you’re not sure which benefits to include, we will provide you a range of quotes that include various levels of each benefit so you can understand them. By having a wide range of providers, we will recommend options that strike the right balance between the cost & benefits.

Underwriting & Pre-exisiting Conditions

A benefit of group health insurance is more types of plans which can benefit your organization, make it easier to claim & get your team covered for any pre-existing conditions.

1) Medical Health Disregarded (MHD)

In short, a type of underwriting where pre-existing conditions can be covered & waiting period waived provided you have enough employees to qualify. It’s possible from just 5 people, albeit expensive. Most international providers require 10+ people or employees for MHD underwriting. Some benefits of MHD:

- As each person isn’t fully underwritten, it makes signing up significantly easier as the providers’ risk is spread out amongst the group.

- It makes claiming easier

- Boost user experience & thus employee satisfaction

However, MHD doesn’t mean everything is covered or direct billing is automatically applied. There is still the list of exclusions that the policy follows amongst other things in the Terms & Conditions.

2) Moratorium Underwriting

Moratorium underwriting is available for some groups, which is simplified and expedited underwriting which states any pre-existing conditions are not covered for a period of two consecutive years, during which time you cannot seek treatment, take mediciation or have an altered lifestyle to treat any ongoing conditions.

3) Full Medical Underwriting (FMU)

FMU underwriting is usually more meant for personal cases, though it could be applied for newer groups, small groups or in the event an employer isn’t paying for the whole policy upfront. FMU requires each individual person to fully declare their health conditions & history and go through the underwriting process.

MHD Material Facts

Even with MHD underwriting, you’d still be required material facts to the provider. This would be major things that would materially change things for your insurer, such as:

- if anyone is currently pregnant

- if anyone is current hospitalized

- if anyone has any upcoming planned surgeries

- if anyone currently undergoing treatments for cancer & or other major critical illnesses

Group Health Insurance Premiums

As you can see, there are many variables that go into your overall group health insurance premium. The premium will vary by provider, benefits, age of your staff & many more things.

If you walk into a phone store, you’ll see a wide variety of phones, different generations, key features, qualities & prices. There are pros & cons to each one, but ultimately you weigh all the factors and make an informed decision.

That’s the same with Employee Benefit Asia, we have contracts with over 40 local, regional & international providers. We are able best find you a provider & plan that draws a healthy balance between costs, benefits & service.

How To Get Quotes for Group Health Insurance

Our process is simple:

- Gather information

- Get quotes

- Present quotes

- Help you make an informed decision

We first need to have a short, transparent conversation to get aligned so we don’t waste your time or ours. To express interest, please fill in a short initial questionnaire OR book a discovery chat.

Application & Timelines

Generally speaking, you want to allocate yourself at least 1 month to get your group health insurance policy set up. The general process:

- Quotations

- Make a decision

- Application

- Underwriting (if any)

- Invoice Issuing

- Payment

- Issue group & individual policy certificates & cards

- Plan rollout to staff

If everything goes right, it’s possible within 1 month, but you should budget 45-60 days prior to you desired start date.

- Steps 1-3 could be done within a couple of weeks, though relies on swift action from all parties (broker, insurer & you)

- Steps 4-8 could be done in another ~2-3 weeks, again relies on swift action.

Plan Rollout

A critical step in ensuring a smooth user experience for you & your team is an insurance presentation with Q&A session with your team (or seperate ones for different tiers). The goal in mind is:

- Set people’s expectations in-line with reality

- Make sure they know what benefit they’re covered for & to what limits

- Explain the direct billing, claims & reimbursement process

- Show them Tenzing Base Camp, or Employeee Portal (see next section for more info)

- Explain what to do in an emergency

- Outline their key contact people

- Show them where to find any documents as a reference

HR & Employee Portal

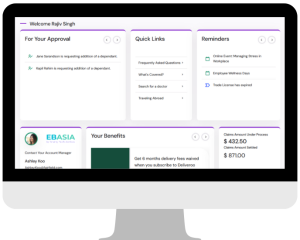

All group health, life & key person insurance clients will receive access to Tenzing Base Camp, our HR & Employee portals. Your starting point for all things your policy.

![]() Group HEalth Insurance: HR Portal

Group HEalth Insurance: HR Portal

- Data, Analytics & Reporting

- Add or remove employees

- Centralized hub for policy docs, past & present

- Live, accurate census

- File claims

- Create Jr. HR portals

- File claims on behalf of management

- Track claims

- Activity logs

- Message active members

- Reduce your administrative burden

- Give staff a digital experience regardless of the insurer

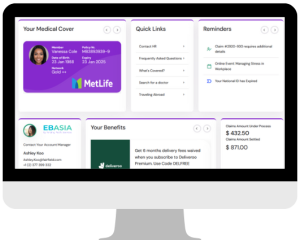

![]() Group HEalth Insurance: Employee Portal

Group HEalth Insurance: Employee Portal

- See policy certificate & card

- Hub for all policy docs & guide

- Look up direct billing faciliites

- File a claim

- Track claims

- Add a dependent

- See broker & provider contact info

- Make requests directly to insurer

- Increased insights

- Reduced turnaround times

- Optional rewards program

- Get special discounts

Direct Billing, Claims & Reimbursments

Your provider will have a Direct Billing list, which you & your team can go to without the needs to pay in advance (in most cases).

That being said, there are times where an employee will need to pay in advance, for example:

- they go somewhere outside the direct billing list

- if the insurer cannot authorize direct billing in the event they need more information

- for certain types of treatments that are not eligible direct billing

If one of your employees needs to pay upfront, Employee Benefits Asia will help them process the claim, submit any necessary paperwork & go through the reimbursement process, liaising between the insurer and your employee.

Midyear Plan Administration

During the policy year, there are a number of things Employee Benefits Asia helps with, a main one is the plan admin for all the people who come & go during the year. The more people, the more admin work, which includes:

- Adding people

- Removing people

- Any of the paperwork associated with doing either of the above

- Invoices

- Plan reconcillations for midyear additions/removals

- Helping new joiners with questions

- Getting anyone newly joined their policy documents, card & certificates

Plan Renewal

We understand that many companies need to get quotes as part of their tendering process, even if they have no intention to change. At Employee Benefits Asia, our renewal process is simple:

Plan Review

review the past year, what worked, what didn't, employee feedback, potential changes to plan

Source Quotes

get quotes for your current provider & go to market with other suitable options

Meet

get new quotes, explain them in a meeting & make a decision

Summary

There are many variables to consider when starting or renewing a group health insurance policy. Cut through the whitenoise by using a professional broker like Employee Benefits Asia to ensure your employees:

- are adequately covered

- at a price that works for your organization

- have a smooth user experience

- have modern technology at their fingertips

- have year-round customer service & someone on their side when something happens

Afterall, you’re providing them an employee benefit, not an employee headaches.

We'd Love to Hear From You

if you found this valuable & would like to explore your group health insurance options, then:

- Book an initial discovery chat below OR

- Express interest by filling in a short quesitonnaire

Group HEalth Insurance: HR Portal

Group HEalth Insurance: HR Portal Group HEalth Insurance: Employee Portal

Group HEalth Insurance: Employee Portal