Employee Retirement Accounts 101

Like Kuby & Huell in Breaking Bad, you’ve probably wondered what it’s like to lay in a massive pile of money.

Unlike them, or Walter White, you don’t have to start a meth empire to enjoy a comfortable retirment.

When it comes to employee benefits, you often think about:

- Salary & Compensation package

- International school fees

- Group health insurance

- Group life insurance

- Housing allowance

But what about retirement benefits? Have you ever seen it advertised in a job post? Do you know anyone who gets a retirement benefit as part of their package?

I’m not talking about state sponsored systems, I’m talking about a company sponsored program. In a recent poll I ran, 93% of respondents replied that they didn’t get any retirement benefits provided by their employer.

About Employee Retirement Plans

International savings & investment providers offer employee retirement accounts, where the plan could either be:

- Company sponsored

- Take by the employees themselves, privately, without your company’s involvement

Employees or employers deposit a fixed monthly contribution into the account for a set period, like 5, 10, 15, or 20 years.

Fund managers invest the contributions into various funds, like the S&P 500 tracker, New Technology, Global equities, eCommerce, North American, Emerging Markets, and more.

A professional fund manager, operating in regulated and safe international jurisdictions, manages each fund and makes investment decisions.

Over time, employees accumulate savings, which they can use for retirement and other purposes.

Key Features of Employee Retirement Plans

- Contributions start as low as $100 USD/month

- Employees can start terms from 5 years or more

- Could introduce a vesting period, minimum period of time before it becomes available to your employee at all

- Companies can implement an employer matching system, where employees contribute $X to their account, and employers match that amount up to a limit

- Your company or your employee can own the plan, depending on how much involvement the company prefers

- Major custodian banks like Citi and BNY Mellon hold the money

- Employees save money internationally in USD, Euro, or GBP

- Available in most countries and to most nationalities, expats or locals

Why Would you Implement Them

Many reasons to, but to name a few:

- Enhance Employee Financial Security

- Make your company a destination company

- Stand out from your competitors

- Reduce employee turnover, hiring costs

Use Case

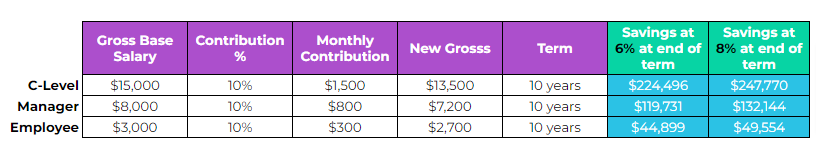

Let’s look at an example with three levels of employees:

Assumptions for the value at the end of the term:

- Contribution % doesn’t change

- Salary doesn’t change

- No contributions are missed

- No lump sums are added

- Return at 6% and 8% respectively, net of all fees (vary by term length)

Imagine your company 5 year from now if you implemented something like this.