Pho-nomenal Expat Health Insurance in Vietnam

Request • Compare • Decide

Note: I focus on “Best Value” modern providers offering the optimal mix of price, benefits, and user experience

Updated February 2025

About Me & My Service

I’ve been an expat health & life insurance broker in Vietnam since 2014, with a special focus on:

- Groups

- Families

- Individuals looking for quality

It does not cost more to use me (or any broker). In fact, many providers don’t have direct teams and rely solely on brokers for their distribution.

Preface

There are so many options in 2025 for expat health insurance in Vietnam. There are good providers, okay one, headache inducing one & ones that should be banned.

I’ve figured this out over thousands of clients, consultations & real-life client experiences over the last 11 years & 25,000+ hours of being a broker. This article is intended to help provide transparency, get you pointed in the right direction & if you find it valuable, I’d love to help you.

My focus is on modern, tech-forward providers that fall squarely into the “best value” category. They’re the best blend of:

- What you get

- What you pay

- User experience

I remain your main point of contact after you take out a policy so your headaches become my headaches & I don’t like headaches, so I don’t offer ones that cause them. If you’re after travel insurance or really budget local health insurance, I’m not the broker for you.

If I can help you I will, if not I’ll be honest upfront. All I ask is transparency back so I can help you cover what matters most.

Which Providers I reccomend

So who do you recommend & how much does it cost?

Which providers I use & recommend to my clients, depends on:

- What’s important to them

- Their budget, preferences & age

- If any pre-existing conditions need consideration

- Future plans

This includes providers in Vietnam & International ones.

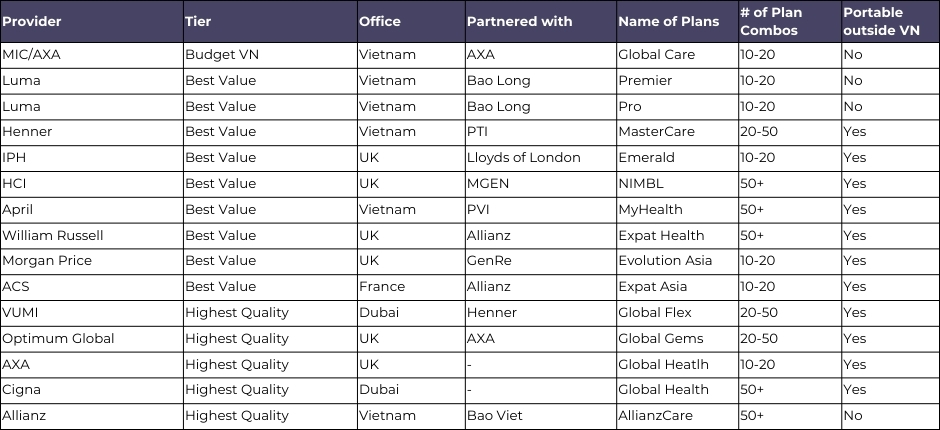

Provider Summary

Provider Key Features & Pricing

Notes:

- IP = inpatient

- OP = outpatient

- Portability = you can keep the policy if you leave Vietnam (important for long-term risk management!)

- Pricing is for regional SE Asia coverage, $0 deductibles & standard rates for age 45

- Younger? You’d pay less

- Older? You’d pay more

Don’t see a provider on there? It’s because I don’t recommend for reasons previously stated

The Benefits: Expat Health Insurance in Vietnam

When selecting expat health insurance in Vietnam, your premium will be influenced, among other things, by the specific benefits chosen & the limits of those benefits. The available benefits are:

Inpatient

• Room & Board

• Surgeries

• Hospitalization Expenses

• Cancer

• Emergency Outpatient

• & many others

Outpatient

• GP & Specialists

• Tests

• Treatments

• Physio & Chiro

• Mental Wellness

• Medication

Wellness

• Annual Health Checks

• Child wellness

• Male/Female Exams

• Early Detection

• Preventative Tests

Dental

• Check-ups & Cleaning

• Crowns, Inlays & Onlays

• Root Canals

• Major Dental Surgery

Maternity

• Pre-natal Visits

• Routine Delivery

• Required C-sections

• Complications

• Newborn Care

Evacuation

• Medical Evacuation

• Repatriation

• Mortal Remains

My Recommendation re: Benefits

My primary concern is about making sure:

- You’re with a decent-to-good provider

- Big ticket items are fully covered for serious things: surgeries, cancer, chronic conditions, extended hospital stays, etc.

Expat health insurance is to prevent serious financial harm or ruin. At minimum take out an emergency inpatient plan. Anything else like outpatient, dental, health checks, etc. is secondary & a cherry on top if your budget allows.

You can easily manage your out-of-pocket expenses by being selective about where you go. This is exactly what I do for myself & my family.

Pricing Variables

There are many variables that go into an expat health insurance premium, they include:

- Age

- Number of People

- Provider Quality

- Benefits Selected

- Benefit Limits

- Coverage Area

- Deductibles/Co-pays

- Type of Underwriting

- How a provider handles their renewals

- Whether a pre-existing condition is covered or not

- Occupational hazards

- BMI

- Whether they offer outpatient direct billing

- Whether your plan is portable or not

- Whether you can seek treatment outside of Vietnam

A single variable can change which provider and plan we recommend. This is why it’s important to work with a reputable broker like Employee Benefits Asia and give them the information required, so we can only put forth the providers and plans that best meet your unique circumstances, preferences & budget.

How to Save Money on your Premiums

Expat health insurance in Vietnam can be cheap or very expensive or somewhere inbetween. If you want a higher quality provider, but if the premiums are bit too much for your allocated budget, then we suggest:

Installments

• Pay monthly

• Pay quarterly

• Pay semi-annually

Reduce Benefits

• Focus on Inpatient

• Skip Outpatient

• Save 50% by doing so

Reduce Area

• Asia focused cover

• Ditch worldwide

• Save 25-30% by doing so

Direct Billing

• Pay & Claim for Outpatient

• Small hassle? Yes

• Save money by doing so

• Claims paid in <7 days

Deductible

• Pay $X out-of-pocket 1st

• Insurance kicks in after

• ex. $1K USD deductible

• Get 20% OFF

Co-pay

• Agree to pay X%

• Example 20% of OP expenses

• Save money by doing so

Pre-Existing Conditions

Pre-existing conditions can be considered for coverage IF they are declared and accepted by the provider during the application phase. Any initial prices you are quoted are the standardized pricing.

They will not include coverage for pre-existing conditions.

As a seasoned broker, I know which providers are more likely to accept declared conditions. From there, an insurer will:

- Have policy exclusion

- Charge a premium fee to cover them

- Reject you if it’s too serious

Some conditions will never be covered under private expat health insurance in Vietnam, which is why it’s important to take out a policy when you are healthy!

Expat Life Insurance in Vietnam

Does anyone rely on you & your income for their wellbeing? Life insurance is a great complement to a health policy. Maximize your value by adding an optional life insurance policy to protect your family or business.

Key Features

- Straightforward, term-life insurance with optional investment element

- Not tied to you living in Vietnam

- Worldwide coverage area & portability

- Policies in USD, Euro or GBP

- Premiums don’t increase with age/inflation

Premiums:

- $37/month for $100K USD, 20-year term for a 40-year old Male

- $30/month for $100K USD, 20-year term for a 40-year old Female

Learn more about Expat Life Insurance here

Signing Up for Expat Health Insurance in Vietnam

The sign-up process can take anywhere from 24 hours to more than 1 week, depending on if there are pre-existing conditions that you seek coverage for & the provider and their internal processes. The steps are:

- Get Quotes

- Get recommended a provider & plan from a health insurance expert (no added costs)

- Make an informed decision

- Submit Application Form

- Underwriting

- Insurance Offer (not binding)

- Invoice Issuance and/or payment link

- Payment

- Issue policy documents & certificate of insurance

We recommend budgeting two weeks before your desired start date.

Get Quotes

My Process

In order to get quotes for expat health insurance in Vietnam, please get in touch with me to get started.

- Get in touch via questionnaire or discovery chat

- Receive quotes digitally

- Have a quick follow-up call or digital meeting to answer your questions, fully explain things & make adjustments based on your feedback.

- Make an informed decision for you, your family or business

Video Resources

FAQs

That depends on the provider, some providers cut off at age 64, 65 or 70. For some provider there is no age cut off. We will only quote you providers you are eligible for.

No, expat health insurance in Vietnam does not require you to get a health check unless something you declare on the application form warrants one. Some providers require a health check for applicants over a certain age.

Typically, we recommend budgeting 1-2 weeks to sign up, that will depend on the provider, type of underwriting and whether there are pre-existing conditions to declare or not.

You can pay via debit or credit card, local bank transfer or international bank transfer. If you have a payment requirement, please tell us during the initial consultation or digital questionnaire.

There could be additional fees to cover high BMI, job hazards, pre-existing conditions, credit card fees & payment installment fees.

No, it is the same cost to use a professional broker like EB Asia by Tenzing Pacific Service as it is to go direct. Some providers only distribute their products via brokers and some providers have direct sales teams. Either way, there are never any additional fees to use EB Asia by Tenzing Pacific Services.

EB Asia by Tenzing Pacific Services is an established insurance broker in Vietnam since 2013. We have contracts wtih over 50 local, regional & international providers.

We help our clients by providing them transparent advice, a comparison of quotes from recommended providers and plans based on your unique needs and budget. We support our clients during your policy year with direct billing, claims, reimbursements and more.

EB Asia is a dedicated brand of Tenzing Pacific Services, designed to focus on employee benefits, groups and personal insurance for business leaders & their families.

That is possible and the rules will depend on the provider. You may be entitled to a prorated refund of the unused days if you have not made a claim.

Tenzing Pacific Services has over 130 perfect 5-star Google Reviews at the time of writing this. This is because we go above & beyond for our clients at all times. In a developing marketing for the insurance industry, we are extremely proud of this.

Yes- we have employees in Ho Chi Minh City, Danang/Hoi An, Bangkok & Pattaya. We can also leverage a quick digital meeting if that’s easier or you do not live in one of those cities.