Benefit Quantity vs. Quality: Group Health Insurance

The age-old debate of quantity versus quality has long fueled discussions in business, education, and personal pursuits. Over my 10 years as a broker, it’s the inspiration for this week’s edition of Employee Benefits Insights.

Let’s take a look group health insurance benefits: Quantity vs. Quality

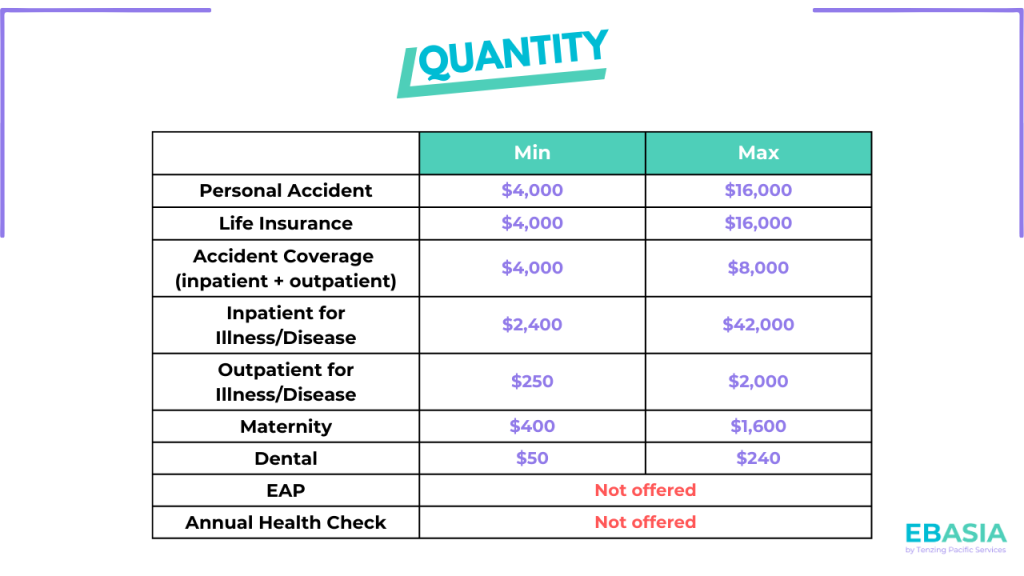

Quantity

Focuses on offering as many different insurance benefits as possible, to say you offer a wide plethora of benefits. That includes:

- Personal Accident

- Life Cover

- Medical Expenses for Accidents (inpatient + outpatient lumped together)

- Inpatient for Illness/Disease

- Outpatient for Illness/Disease

- Dental

- Maternity

In order to provide that many benefits and stay within budget, it means offering very low limits for each of them. For example, a typical Thai, Vietnamese, etc. local plan has limits like so (converted to USD):

By offering so many benefits, the most important & used benefits, inpatient & outpatient, have such low limits that and expose your employees to personal financial risk.

$4K USD worth of accidents + $5K USD for inpatient does not go very far in the 2024 with the rising cost of healthcare in Asia.

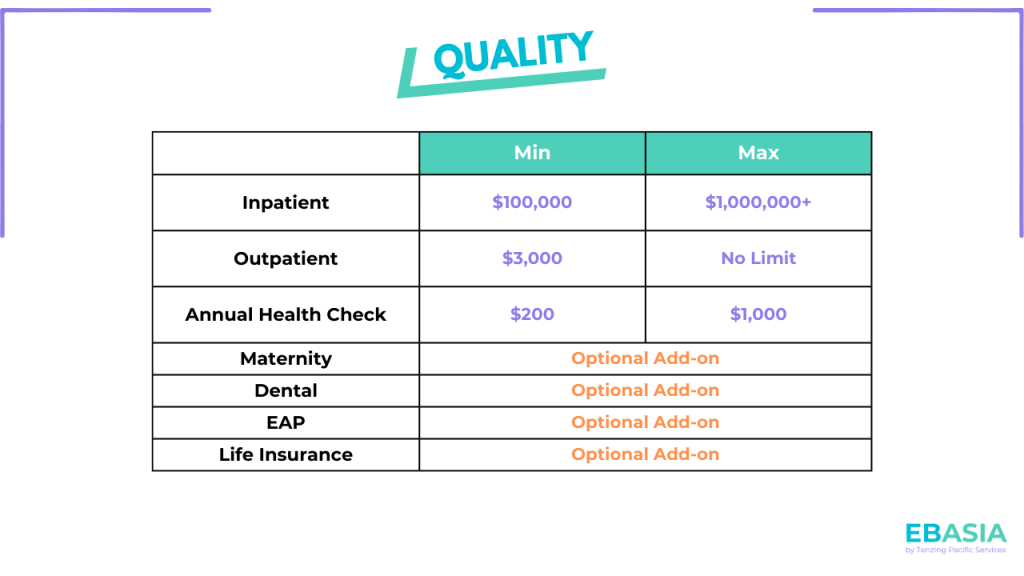

Quality

Instead, what I always recommend is simple. Focus on the most important benefits first: inpatient & the most used benefit next: outpatient. Do this with providers who offer higher limits that reduce out-of-pocket financial risk.

Anything else is the cherry on top if it’s within your employee benefits budget.

A normal group health insurance plan that I recommend focuses on:

1) Inpatient: make sure your employees are covered for big-ticket medical incidents; surgeries, cancer, heart attacks and all the related medical expenses that cost a lot and would cause serious financial harm or ruin.

2) Optional add outpatient, the most used benefit, normally the limit is $4K USD, $5K USD or Unlimited

3) Annual Health Checks– If you do add outpatient, then get an annual health check to identify issues early, allowing for timely action.

If you have room in budget for anything else, great. If not, rest easy knowing you & your staff have mitigated your risks (the point of insurance).

Case in Point

No matter how safe you are, healthy you are, what your diet & exercise regime is, the simple fact of the matter is life happens. Bad things happen that you cannot control.

Recently a C-Level executive client of mine got a group health insurance policy which focused on qualityover quantity: Inpatient to $1M USD & Outpatient to $10K.

The executive was diagnosed with cancer which required multiple surgeries & ongoing treatments to the tune of $80K USD.

Imagine if they had gone down the route of quantity and had an annual limit of $8K USD (common maximum sum insured for local providers).

Let that sink in.

All insurance is, is a transfer of risk from you, your company, your bank account, your life savings to an insurer. Focus on the big-ticket items that can seriously financially harm or destroy you.

✋Need help?

If you’re looking to protect yourself, family or business, please get in touch to start an open dialogue, get a custom proposal & make an informed decision.