Ultimate Guide to Group Life Insurance

A comprehensive guide to group life insurance for businesses of any size looking to enhance their employee benefits offering.

Group Life Insurance Preface

Group life insurance is an essential employee benefit that offers financial security to employees’ families in the event of an untimely death. This comprehensive guide will cover everything you need to know about group life insurance, including its benefits, underwriting processes, coverage limits, and more.

Group Life Insurance Providers

Unlike group health insurance, there are not as many international providers offering global group health insurance policies. They include, but are not limited to:

Providers:

- Allianz

- Atlas Life

- Unisure

- Manhattan Trust

- Manulife

- William Russell

Reinsured by:

- Swiss Re

- Gen Re

- Reinsurance Group America

- & more

With so many options, we recommend using a reputable insurance broker in your search for group health insurance. It saves you time, hassle & headaches of sourcing quotes, understanding them & putting them together in an apples-to-apples comparison. Just use a broker like EB Asia and get an expert on your side and added customer service without any additional charges.

Group Life Insurance Benefits

There are many different ways to structure your policy:

Death Benefits

provides financial security for your beneficiaries in the event of your death, regardless of the cause.

Critical Illness

offer coverage that can help with expenses if an employee is diagnosed with a serious illness

Disability Benefits

include benefits that support your employees financially if they become disabled and unable to work

Personal Accident

provide supplemental coverage for accidents that result in death or total or partial disablement

Income Replacement

help replace lost income, ensuring financial stability for your family if you're unable to work.

Which benefits you take is ultimately up to you & varies by organization. We can help advise based on the norms of your industry, trends & from our experience.

If you’re not sure which benefits to include, we will provide you a range of quotes that include various levels of each benefit so you can understand them. By having a wide range of providers, we will recommend options that strike the right balance between the cost & benefits.

Why get Group Life Insurance?

Group life insurance provides several advantages for both employers and employees. For employers, offering group life insurance can enhance the overall benefits package, making the company more attractive to potential employees and improving retention rates. For employees, the primary benefit is financial protection for their families in the event of their death. Additionally, group policies often come at a lower cost compared to individual policies due to the pooled risk.

Other benefits include:

- Ease of Enrollment: Typically, employees can enroll in group life insurance plans during the onboarding process or open enrollment periods with minimal paperwork.

- Cost-Effective: Group life insurance is usually less expensive than individual policies because the risk is spread across a large number of people.

- Automatic Coverage: Employees often receive automatic coverage up to a certain limit without needing to undergo medical exams.

- Portability: Some plans allow employees to convert their group coverage to an individual policy if they leave the company.

- Worldwide Coverage: cover where your employee work, live & travel to

- Major Global Currencies: get coverage in major global currencies like USD, GBP & Euro, which generally hold their value over time better

Simplified Underwriting

Simplified underwriting is a streamlined process that requires less detailed health information compared to traditional underwriting. This approach reduces the time and effort needed to obtain coverage and is particularly advantageous in a group setting where the insurer can spread the risk across many employees.

Key aspects of simplified underwriting include:

- Basic Health Questions: Applicants may need to answer a few health-related questions rather than undergo a full medical examination.

- Quick Approval: With less stringent requirements, the approval process is faster, allowing employees to gain coverage more quickly.

- Lower Premiums: Because the process is simplified, administrative costs are reduced, which can result in lower premiums for policyholders.

Group Life Insurance Free Cover Limit

The free cover limit, also known as the non-evidence limit (NEL), is the amount of insurance coverage an employee can receive without providing evidence of insurability, such as medical exams or detailed health questionnaires. This limit varies based on the size of the group and the insurer’s underwriting policies.

- Automatic Enrollment: Employees are automatically covered up to the free cover limit when they join the plan.

- No Medical Evidence Required: Up to this limit, employees do not need to submit any medical information, making it easier and quicker to obtain coverage.

- Varies by Employer: The free cover limit can vary significantly from one employer to another, depending on the overall health profile of the workforce and the negotiated terms with the insurer.

Waived Medical Exams

One of the significant advantages of group life insurance is the waived medical exams for coverage up to a certain limit. This feature is particularly beneficial for employees who might have difficulty qualifying for individual life insurance due to pre-existing health conditions.

- Immediate Coverage: Employees receive immediate coverage without the need for time-consuming medical examinations.

- Inclusivity: This provision makes life insurance accessible to employees who might otherwise be excluded from individual policies due to health issues.

- Streamlined Process: Waiving medical exams simplifies the enrollment process, making it more efficient for both the employer and employees.

Group Life Insurance Payout Triggering Events

Group life insurance policies are designed to pay out benefits upon certain triggering events, primarily the death of the insured employee. However, some policies may also provide payouts under additional circumstances, such as terminal illness diagnoses.

- Death: The primary triggering event for a payout is the death of the insured employee. The policy provides a lump sum payment to the designated beneficiaries.

- Diagnosis of Terminal Illness: Some policies include a terminal illness rider, allowing the insured to receive a portion of the death benefit if diagnosed with a terminal illness.

- Accidental Death and Dismemberment (AD&D): This rider provides additional benefits if the insured dies or suffers a severe injury (such as loss of a limb) due to an accident.

Optional Critical Illness

Many group life insurance policies offer optional critical illness coverage, which provides a lump sum payment if the insured is diagnosed with a specified critical illness. This coverage can help cover the costs associated with severe health conditions and provide financial stability during difficult times.

- Coverage for Major Illnesses: Commonly covered illnesses include cancer, heart attack, stroke, and major organ transplants.

- Financial Support: The lump sum payment can be used to cover medical expenses, rehabilitation costs, or any other financial needs during the recovery period.

- Enhanced Protection: Adding critical illness coverage enhances the overall benefits package and provides additional peace of mind for employees.

Optional Disability

Optional disability coverage can be included in a group life insurance plan to provide income replacement if an employee becomes disabled and unable to work. This benefit ensures financial stability for employees who are unable to earn their regular income due to a disability.

- Income Replacement: The coverage typically provides a percentage of the employee’s salary if they become disabled and cannot work.

- Short-Term and Long-Term Options: Policies may offer both short-term and long-term disability options, covering different durations and severities of disability.

- Critical Support: This benefit is crucial for maintaining financial security and quality of life during periods of disability.

Group Life Insurance Census Information

To obtain accurate quotes for group life insurance, insurers require an employee census. This census includes detailed information about the employees to assess the overall risk and determine the premiums. Common census items include:

- Date of Birth

- Gender

- Nationality

- Residence Country

- Employee Tier

- Smoking Status

- Income

These are the types of variables that go into pricing, not all of these will be required it varies by provider.

How To Get Quotes for Group Life Insurance

Our process is simple:

- Gather information

- Get quotes

- Present quotes

- Help you make an informed decision

We first need to have a short, transparent conversation to get aligned so we don’t waste your time or ours. To express interest, please fill in a short initial questionnaire OR book a discovery chat.

Group Life Insurance Exclusions

Group life insurance policies typically include certain exclusions, which are situations where the policy will not pay out benefits. Understanding these exclusions is essential for both employers and employees.

- Suicide Exclusion: Many policies include a suicide exclusion clause, meaning no benefits will be paid if the insured commits suicide within a specified period (usually two years) after the policy starts.

- War and Terrorism: Deaths resulting from acts of war or terrorism are often excluded from coverage.

- Illegal Activities: Deaths occurring while the insured is participating in illegal activities are generally not covered.

- Pre-Existing Conditions: Some policies may exclude deaths related to pre-existing health conditions, although this is less common in group policies.

Beneficiary Declarations

Employees must declare beneficiaries to receive the death benefit from a group life insurance policy. This declaration ensures that the benefits are distributed according to the employee’s wishes in the event of their death.

- Primary and Contingent Beneficiaries: Employees can designate primary beneficiaries, who will receive the benefits first, and contingent beneficiaries, who will receive the benefits if the primary beneficiaries are unavailable.

- Regular Updates: Employees should regularly review and update their beneficiary designations to reflect life changes, such as marriage, divorce, or the birth of a child.

- Clear Instructions: Providing clear instructions for beneficiary declarations helps prevent disputes and ensures a smooth distribution of benefits.

Application & Timelines

During the policy year, there are a number of things Employee Benefits Asia helps with, a main one is the plan admin for all the people who come & go during the year. The more people, the more admin work, which includes:

- Adding people

- Removing people

- Any of the paperwork associated with doing either of the above

- Invoices

- Plan reconcillations for midyear additions/removals

- Helping new joiners with questions

- Getting anyone newly joined their policy documents, card & certificates

Plan Rollout

During the policy year, there are a number of things Employee Benefits Asia helps with, a main one is the plan admin for all the people who come & go during the year. The more people, the more admin work, which includes:

- Adding people

- Removing people

- Any of the paperwork associated with doing either of the above

- Invoices

- Plan reconcillations for midyear additions/removals

- Helping new joiners with questions

- Getting anyone newly joined their policy documents, card & certificates

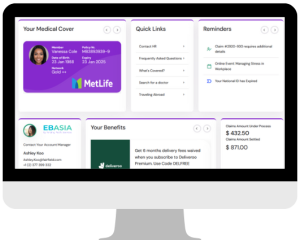

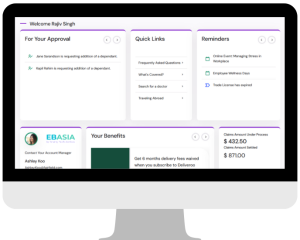

HR & Employee Portal

All group health, life & key person insurance clients will receive access to Tenzing Base Camp, our HR & Employee portals. Your starting point for all things your policy.

![]() Group Life Insurance: HR Portal

Group Life Insurance: HR Portal

- Data, Analytics & Reporting

- Add or remove employees

- Centralized hub for policy docs, past & present

- Live, accurate census

- File claims

- Create Jr. HR portals

- File claims on behalf of management

- Track claims

- Activity logs

- Message active members

- Reduce your administrative burden

- Give staff a digital experience regardless of the insurer

Group Life Insurance: Employee Portal

- See policy certificate & card

- Hub for all policy docs & guide

- Look up direct billing faciliites

- File a claim

- Track claims

- Add a dependent

- See broker & provider contact info

- Make requests directly to insurer

- Increased insights

- Reduced turnaround times

- Optional rewards program

- Get special discounts

Plan Renewal

We understand that many companies need to get quotes as part of their tendering process, even if they have no intention to change. At Employee Benefits Asia, our renewal process is simple:

Plan Review

review the past year, what worked, what didn't, employee feedback, potential changes to plan

Source Quotes

get quotes for your current provider & go to market with other suitable options

Meet

get new quotes, explain them in a meeting & make a decision

Summary

There are many variables to consider when starting or renewing a group health insurance policy. Cut through the whitenoise by using a professional broker like Employee Benefits Asia to ensure your employees:

- are adequately covered

- at a price that works for your organization

- have a smooth user experience

- have modern technology at their fingertips

- have year-round customer service & someone on their side when something happens

Afterall, you’re providing them an employee benefit, not an employee headaches.

We'd Love to Hear From You

if you found this valuable & would like to explore your group health insurance options, then:

- Book an initial discovery chat below OR

- Express interest by filling in a short quesitonnaire